COMMITTEE NEWS

Committee Priorities:Advocacy-HighBusiness-Medium (information sharing)Community-Low (networking)

MISSION

To improve the policy environment in ways that benefit both the industry and members.

To share and discuss cross-sector business and policy issues to get smarter about the industry. To strengthen closer communication and cooperation

for the broader technology space between the US and China.

MAIN ACTIVITIES

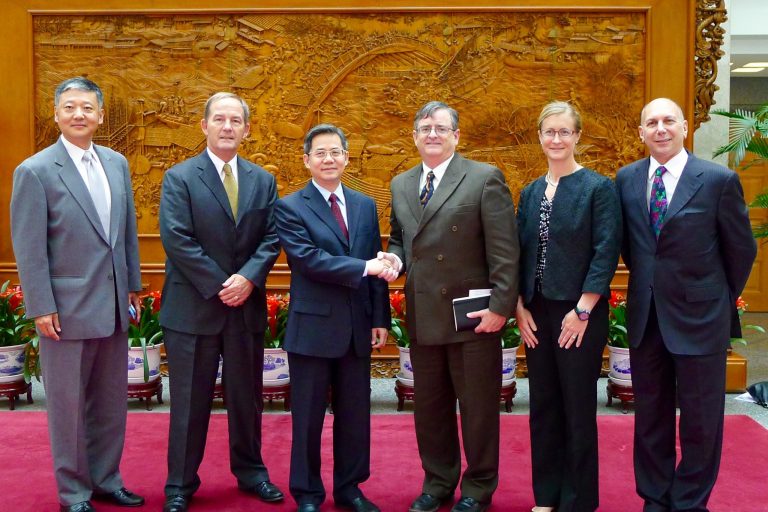

- ICT Chapter (drafted by Committee members) in annual AmCham China White Paper.

- White Paper Delivery Meeting with central government agencies – CAC 国家互联网信息办公室,MIIT 工业和信息化部, MOST 科技部.

- Call for comments helps members deliver their messages, suggestions, and feedback to central government for new policies and regulations.

- Debriefing Events (Closed door) – invite industry experts and officials to explain new policies and discuss topical issues with members.

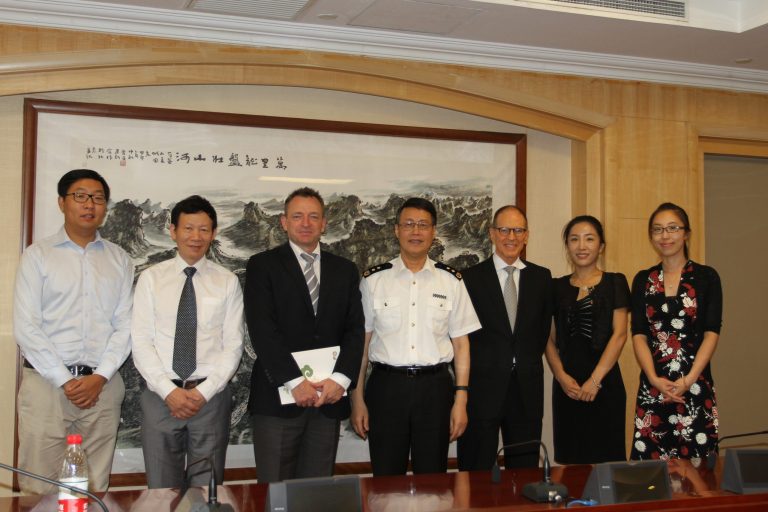

- Member Delegation Visits to provincial governments for direct exchange of ideas on specific issues.

2022 COMMITTEE STRATEGIC FOCUS

Advocacy (A)

High Priority

Government Access:

Advocacy to central government regulators on areas where members have common needs

Business (B)

Medium Priority

Connected and Autonomous Vehicles:

Understand how the fast-evolving automobile industry is transforming into the high-tech space.

Community (C)

Low Priority

Events:

Welcome Mixer at the beginning of the year. At least two community-oriented events in partnership with other industry associations

Partnerships: To grow Committee membership and deepen our advocacy impact, we hope to cooperate with major associations such as USITO, SIA, and SEMI where possible. We will also build relationships with government think tanks and member consulting firms with expertise in the ICT area, as well as PE and VC member firms focused on technology.

STRATEGIC PLAN

I am text block. Click edit button to change this text. Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

1. US-China relations & China’s reform

Dual Circulation model

Equal treatment

Market access vs Permit to operate ( 准入vs 准营)

IPR

2. Enforcement of Laws & Regulations

Improving business environment

Carbon Neutrality / Environmental Law and policies

IPR

Tax

4. Cybersecurity

Level playing field

Emphasis on self reliance

Regional development

3. Industrial Policies

Balance between development and security

Clear regulation and enforcement environment

Alignment with international regulation norms

WORKING PLAN

Q1

- Strategic planning meeting to finalize committee policy priorities and annual work plan in 2022

- Support drafting and review of White Paper

Q2

- Support launch of annual White Paper and strategize the chamber’s Chinese govern mentengagement plan for our 2022 White Paper Delivery Meeting process

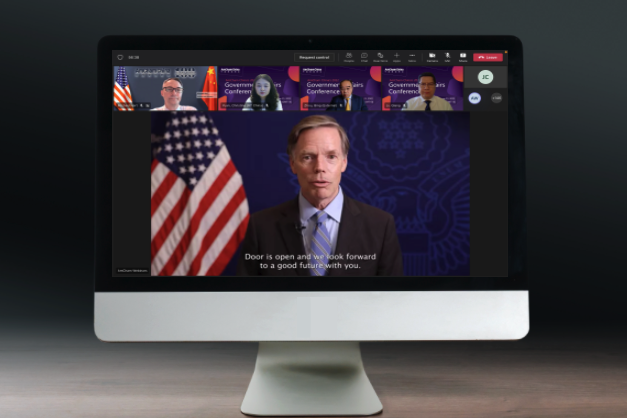

- Host Government Affairs Conference

- Support a Business Investment Outreach Trip

Q3

- Support a Business Investment Outreach Trip

- Support strategy for annual Appreciation Dinner planning

Q4

- Provide guidance in inviting Chinese government keynote speaker for the annual Appreciation Dinner

- Co-organize AmCham China 2022 Policy Priorities Planning Meeting, together with the Policy Committee

- Finalize CGAC annual working report to share with all members

LEADERSHIP

AmCham China Supporting Staff: vacant

MEMBER PROFILE

Among our 86 member companies in this sector, 60+ are in the ICT Committee.

In total, 200+ members participate in the ICT Committee.

ACTIVE COMMITTEE MEMBERS

Hardware

AMD (China)

Apple Computer Trading

(Shanghai)

Apple Procurement &

Operations Management

(Shanghai)

Applied Materials (Xi’an)

Axcelis Technologies

Semiconductor Trading (Shanghai)

Beijing Tongmei Xtal Technology

CHAYORA HOLDINGS

Coherent

CSMC Technologies Fab2

Dell (China)

Epoch Technologies (Dalian)

Freescale Semiconductor (China)

Genuine Zebra Technologies

Trading (Shanghai)

GLOBALFOUNDRIES China

(Shanghai)

Hewlett Packard Enterprise

HPI

IBM China Company Limited

IBM Dalian Global Delivery

Company Limited

Intel China

Kingston Technology

KLA-Tencor International Trading

(Shanghai)

Lam Research Service Beijing

Branch

Lenovo (Beijing)

Microchip Technology Trading

(Shanghai)

Micron Semiconductor (Xian)

NVIDIA Technical Service (Beijing)

Qorvo (Beijing)

ROBOROCK TECHNOLOGY

Seagate Technology

Sony (China)

Texas Instruments Semiconductor

Technologies (Shanghai)

Software, SaaS, and PaaS

Akamai (Beijing) Technologies

Amazon Joyo

AspenTech (Beijing)

Autodesk Software (China)

Baidu Online Network Technology

(Beijing)

Beijing Cadence Information

Technology

DXC Technology

Beijing R&D Institute of New H3C

Technologies

Bentley Systems (Beijing)

Beyondsoft

DoubleBridge Technologies

Entrust Datacard China

F5 Networks China

Glue Up

Google Information Technology

(China)

Inspur Worldwide Services

iSpring Shenzhen Software Limited

Company

LinkedIn China

Meta

Microsoft (China)

Neuro EdTech

Northern Lights Tech Development

(Tianjin)

Objectiva Software Solutions

Oracle (China) Software Systems

Otus LLC

Parametric Technology (Shanghai)

Software

Plug and Play

Qualcomm Wireless

Communication Technologies

(China)

Redhat

SAS Research and Development

(Beijing)

SCRY CITY USA LLC

SOHU

Synopsys (Beijing) Company

Limited

Synopsys Software Information

(Wuhan)

The Mathworks Software (Beijing)

ThoughtWorks Software

Technologies (Beijing)

United States Information

Technology Office (USITO)

Veritas Technologies (Beijing)

VMware Information Technology

(China)

Wind River Systems

Xi’an Telenav Software

Zoom Video Communication

Telecommunications Equipment

and Services

CIeNET Technologies

Ericsson (China)

Juniper Networks Consulting

(Shanghai) Beijing Branch

Keysight Technologies( China)

Polycom Communications

Technology (Beijing)

Syniverse Technologies (Beijing)

Telstra Corporation Limited

Managed Services

Beijing Zu Rui

Technology

Lionbridge Technologies (Jinan)

Top Global IT